How to Find the Most Affordable Auto Insurance Rates for Your Automobile

How to Find the Most Affordable Auto Insurance Rates for Your Automobile

Blog Article

Maximize Your Satisfaction With the Right Auto Insurance Coverage Plan

Navigating the intricacies of auto insurance policy can often really feel frustrating, yet it is essential for guaranteeing your peace of mind on the road. The most efficient techniques for tailoring your auto insurance coverage strategy may not be quickly noticeable-- this conversation will certainly reveal necessary insights that can change your technique to coverage.

Understanding Auto Insurance Policy Fundamentals

Recognizing the principles of automobile insurance coverage is crucial for every single vehicle proprietor. Vehicle insurance policy works as a monetary safeguard, securing individuals from prospective losses arising from mishaps, theft, or damage to their vehicles. At its core, vehicle insurance policy is comprised of different protection types, each made to attend to particular dangers and liabilities.

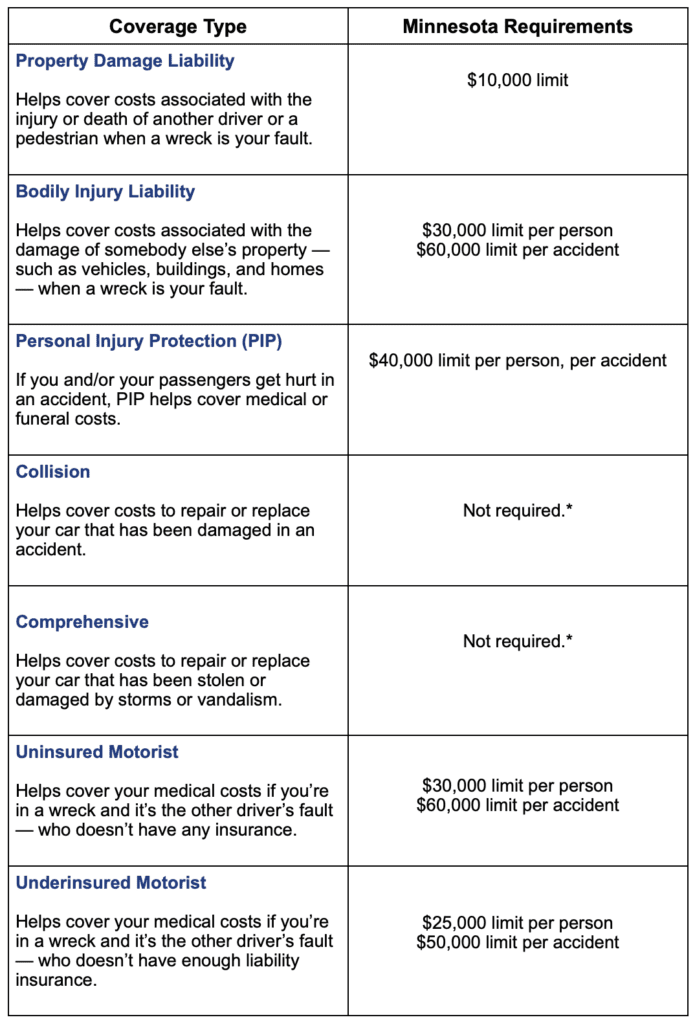

The key parts include responsibility insurance coverage, which safeguards against damages brought upon on others in a mishap; collision coverage, which spends for fixings to your car after a collision; and thorough coverage, which covers non-collision-related cases such as theft or natural catastrophes. Additionally, lots of policies supply injury protection (PIP) or uninsured/underinsured vehicle driver coverage, which can offer vital assistance in case of a mishap with an at-fault motorist that lacks enough insurance coverage.

Costs for car insurance are affected by a multitude of aspects, including the driver's background, the sort of automobile, and local policies. Understanding these essentials gears up automobile proprietors to navigate the intricacies of their plans, ultimately bring about informed decisions that line up with their distinct needs and conditions.

Analyzing Your Protection Needs

When establishing the ideal vehicle insurance coverage, it is essential to examine specific situations and threat variables. Understanding your driving practices, the type of car you own, and your monetary circumstance plays a considerable function in choosing the right policy.

Regular commuters or those that usually drive in high-traffic locations may require even more detailed coverage than periodic vehicle drivers. Newer or high-value vehicles typically profit from accident and comprehensive insurance coverage, while older cars may just need liability insurance coverage.

Additionally, your personal properties ought to be considered. If you have significant possessions, higher responsibility limits might be required to shield them in instance of an accident. Lastly, assess your convenience level with threat. Some individuals like to pay greater premiums for added satisfaction, while others may pick very little coverage to save cash.

Contrasting Insurance Coverage Companies

Next, consider the series of coverage alternatives each provider offers. Search for policies that straighten with your details needs, including liability, crash, extensive, and uninsured vehicle driver insurance coverage. Additionally, take a look at any type of offered add-ons, such as roadside assistance or rental vehicle compensation, which can improve your policy.

Rates is one more essential variable. Get quotes from numerous companies to understand the price differences and the coverage offered at each rate point. Be aware of the restrictions and deductibles related to each plan, as these elements considerably influence your out-of-pocket costs in the occasion of a claim.

Finally, assess the cases process of each service provider. An uncomplicated, effective insurance claims procedure can greatly influence your total fulfillment with your auto insurance policy experience.

Tips for Reducing Premiums

Many motorists are anxious to discover means to lower their auto insurance policy costs without compromising crucial coverage. One efficient method is to enhance your insurance deductible. By choosing for a greater insurance deductible, you can considerably reduce your month-to-month costs; however, guarantee that you can easily manage the out-of-pocket expenditure in instance of a claim.

Another method is to benefit from price cuts supplied by insurance providers. Several companies offer cost savings for aspects such as risk-free driving documents, click to read more bundling multiple policies, or having certain security functions in your lorry. Always ask regarding offered price cuts when getting quotes.

Maintaining an excellent credit history score can also lead to reduced premiums, as several insurance firms think about credit report when identifying prices. Routinely evaluating your credit history report and dealing with any type of discrepancies can assist enhance your score over time.

Last but not least, take into consideration the kind of car you drive. Cars and trucks that are more affordable to repair or have higher safety scores frequently come with reduced insurance policy expenses. By assessing your vehicle selection and making notified decisions, you can properly handle your auto insurance policy expenses while guaranteeing ample protection remains undamaged.

Examining and Updating Your Plan

On a regular basis examining and updating your automobile insurance plan is vital to make certain that your protection aligns with your present needs and conditions. auto insurance. Life adjustments, such as buying a new lorry, transferring to a various location, or adjustments in your driving habits, can significantly affect your insurance demands

Begin by analyzing your current insurance coverage limitations and deductibles. If your lorry's value has decreased, you may wish to adjust your crash and comprehensive protection as necessary. Furthermore, take into consideration any new discount rates you might certify for, such as those for risk-free driving or packing plans.

It's additionally prudent to evaluate your personal situation. As an example, if you have actually experienced substantial life events-- like marriage or the birth of a kid-- these might necessitate an upgrade to your policy. Furthermore, if you have actually adopted a remote work arrangement, your daily commute might have transformed, possibly impacting your insurance coverage needs.

Last but not least, consult your insurance policy supplier at the very least every year to talk about any type of changes in rates or insurance coverage choices. By taking these positive steps, you can make sure that your automobile insurance coverage offers the most effective protection for your advancing lifestyle.

Conclusion

To conclude, choosing the suitable vehicle insurance policy strategy calls for a comprehensive understanding of coverage kinds and cautious assessment of individual demands. By contrasting numerous insurance coverage companies and actively looking for discounts, policyholders can attain an equilibrium between ample security and affordability. Regularly assessing and updating the plan makes certain continued importance to altering conditions. Eventually, an appropriate car insurance coverage strategy serves to boost comfort, giving both financial security and confidence while browsing the roads.

The most reliable techniques for tailoring your automobile insurance policy plan may not be quickly apparent-- this discussion will uncover essential insights that could transform your method to protection.

In the procedure of picking Read More Here a vehicle insurance see post policy provider, it is important to conduct an extensive comparison to ensure you find the finest protection for your needs - auto insurance. By examining your lorry selection and making informed choices, you can successfully handle your car insurance coverage expenses while ensuring ample insurance coverage remains intact

In verdict, choosing the suitable auto insurance policy plan needs an extensive understanding of coverage kinds and cautious evaluation of specific needs.

Report this page